Amazon is one of the largest e-commerce companies and a tech hub. This giant hub is also ranked in the top 5 NASDAQ stock lists. The value of this stock has increased by 75% over the past year. So, if you are planning to invest in AMZN, then you need to know about the risks and fundamentals of Amazon’s stock price.

In this article, let’s reveal all the fundamentals and risks of Amazon stock to get an approximate Amazon stock price prediction 2030. So, without wasting any more time, let’s get started.

Is Amazon stock a Good Buy?

Before jumping into the Amazon stock price prediction 2030 you need to understand what professionals say about this stock. Is Amazon a good stock to invest in? So the genuine and straightforward answer is yes. Amazon is a best-buy stock.

However, there are several factors you need to consider before jumping to a conclusion. The first thing is that it is not financial advice, so consult any financial expert to identify your goals for investing in stocks. If your goal is to invest for your retirement, then you can go with this stock. I’ll not 100% guarantee you, but the fundamentals of this stock suggest a good buy choice.

According to stock and market analysis experts, for long-term investment, AMZN is one of the best stocks to invest in. Currently, Amazon.com, inc. (AMZN) stock price is around $154.07 (December 19, 2023) on NASDAQ. Check out the other essential fundamentals of AMZN below.

Amazon Fundamentals

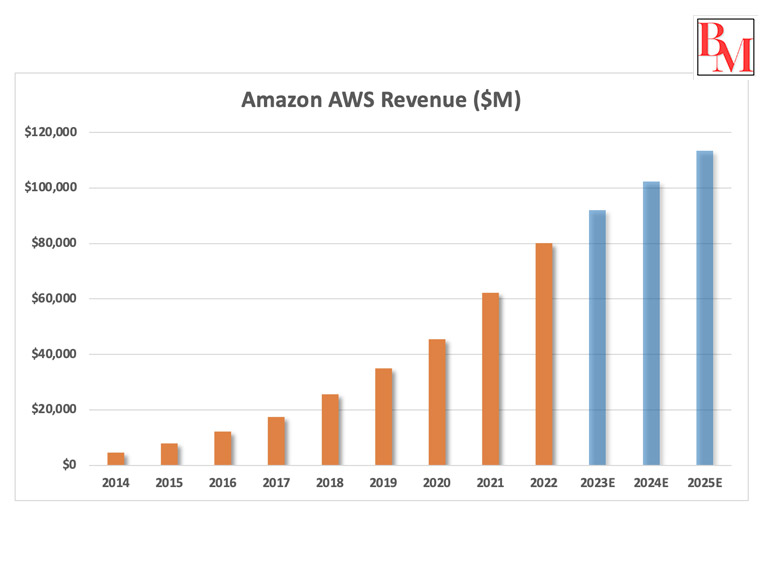

This part is very important to get the result of Amazon stock price prediction for 2023 after the split. In 2022, Amazon’s share dropped by 50% because of the share split and other factors. However, in this year (2023), AMZN is doing an incredible job and is currently up by 71% from the drop because of its strong and reliable fundamentals.

| Market Cap | 1.52T |

| P/E Ratio | 76.78 |

| Revenue | 554.03B |

| Net Income | 20.08B |

| Volume | 41,905,965 |

| Div Yield | N/A |

| 52 Weeks High | $149.26 |

| 52 Weeks Low | $81.43 |

| Analysts Suggesting | Strong Buy And Hold |

The reason behind the 2022 drop in Amazon stock is the stock split news. On March 9, 2022, Amazon announced a 20-1 stock split and a buyback order of $10 billion. This creates confusion among retail investors. The fear of losing money caused panic sales that’s why we saw the price drop of Amazon stock.

The board of Amazon Inc. said,

The stock split would give our employees more flexibility in how they manage their equity in Amazon and make the share price more accessible for people looking to invest.

In 2022, Amazon reported its first quarterly loss. In seven years, this is the first loss Amazon has had to face. However, there are many reasons behind the split. Some experts say poor supply chain management, poor management, and a huge investment in EV startup Rivian caused this loss and split stock. On the other hand, some experts say the real reason behind the Amazon 2022 stock split is the buyback order.

Amazon Stock Price Prediction 2030

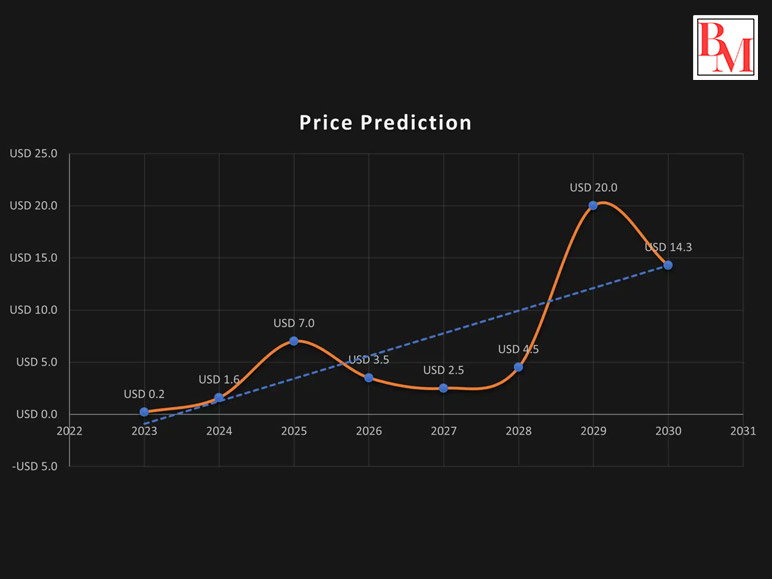

If you are confused about whether to buy Amazon stock or not, then you need to check out this Amazon stock price prediction for 2030. Remember, this is a prediction, not investment advice. I’ll share this information only for general information purposes.

According to the current state of AMZN’s stock price, the technical indicator indicates a bullish sentiment. Over the last 30 days, the price volatility has been 1.85%. Here is a future price forecast of Amazon stock using the same fundamental basics over the past 10 years of average yearly growth.

| Years | Predicted Price At The End of Each Year | Growth Change Percentage (approx) |

| 2024 | $195 | 26.6% |

| 2025 | $248 | 60.50% |

| 2026 | $310 | 101.05% |

| 2027 | $397 | 158% |

| 2028 | $500 | 225% |

| 2029 | $635 | 312% |

| 2030 | $805 | 422.10% |

2025 Amazon Stock Price

Using the same fundamental basics, the analysis indicates that in 2025, Amazon’s stock price might touch the $247.10 markup. If Amazon continues to grow in the same range, then the price will increase by 65%.

2030 Amazon Stock Price

In 2030, the prediction says Amazon stock might reach $805.31 if it successfully maintains its last 10 years’ average growth. Amazon could have a market cap of around $2.6 trillion by the year 2030. It could grow even more due to its branching into new areas, including AI and EV, in addition to its e-commerce and cloud services.

What Affects The Stock Price Of Amazon?

The price of Amazon stock depends on basic supply and demand factors. These supply and demand dynamics can be influenced by various factors including new announcements, investments, mergers, acquisitions, etc. Market sentiment, economic conditions, and other market rates including inflation, and interest rates can also affect Amazon’s stock price. This means the above-mentioned Amazon stock price prediction for 2030 might be affected by these factors.

Can I Invest $1,000 In Amazon?

Amazon is the top 3 stock on the NASDAQ’s top stock list. The 75 PE ratio and reliable growth results indicate it is one of the most steady and trustworthy stocks to invest in for the long term.

JPMorgan analyst Doug Anmuth said the lawsuit,

was very much as expected, and we believe it will be challenging to prove that AMZN illegally maintains monopoly power.

However, a long-term investment and diversified portfolio strategy is the best investment advice to keep your investment goal less volatile if you invest in stocks.

Where To Invest $1,000 Right Now?

If you are ready to invest and want a little suggestion, then my suggestion will be to create a diversified portfolio. Just research the top 10 or top 20 stocks on NASDAQ, then invest equally to reduce risk. This will help you fight any uncertain market situation.

You can also invest in different areas, including cryptocurrency, mutual funds, ETFs, Real Estate, gold, etc. This investment strategy allows you to take advantage of different trends and opportunities. If you diversify your investment, then the volatility of your investment will decrease.

CONCLUSION

In the end, with successful e-commerce services, web services, cloud services, and advertising, Amazon is among the top companies. Putting it together shows that Amazon is heading towards a $2.5 trillion market cap. The prediction analysis shows that the annual growth rate of Amazon will be around 7.6%.

According to the NASDAQ reports, Amazon has the potential to grow larger by 2030 due to its strong leadership and stable fundamentals. If you have any other questions regarding this article, feel free to ask me in the comment section. Also, read these similar articles below…

Additional: