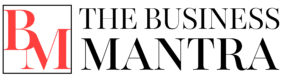

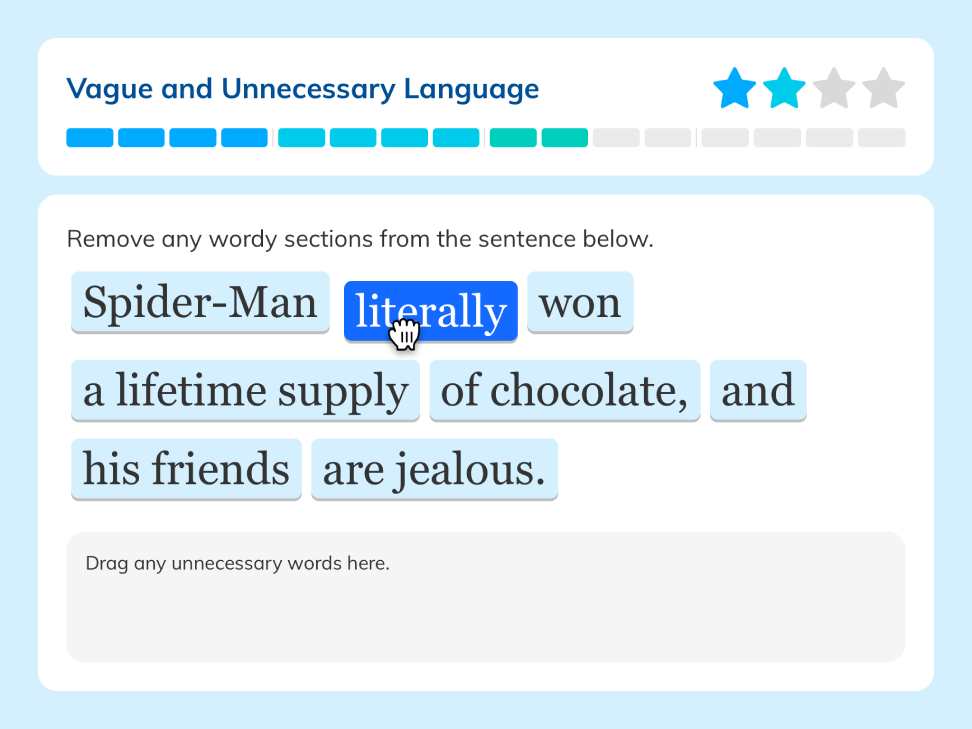

Imagine a classroom filled with fun instead of red marks! That’s kind of what NoRedInk is like for writing. It’s a website that helps students in grades 5-12 learn and practice grammar, punctuation, and other writing skills in a way that’s engaging and interactive. Think of it like a game for writing: you answer questions, complete activities, and earn points as you progress.

NoRedInk makes learning the nitty-gritty of writing less boring and more like a treasure hunt for grammar rules. Best part? No more scary red marks. The site uses positive reinforcement and gives you tips along the way, so you feel confident to improve your writing without feeling bad about mistakes. It’s like having a personal writing coach who cheers you on!

So, next time you’re feeling lost in the jungle of commas and colons, remember NoRedInk – it’s your friendly guide to conquering the world of writing, one sentence at a time!

Ah, the elusive goal of “no red ink.” It’s a phrase whispered in financial advice circles, scribbled on budgeting notebooks, and dreamt of by individuals yearning for financial peace. But what exactly is No Red Ink? Is it some mystical budgeting app? A secret society of debt-free millionaires? Or simply a clever marketing slogan?

Fear not, fellow budget travelers! We’re here to demystify the magic of No Red Ink and equip you with the tools to paint your financial canvas in vibrant green.

No Red Ink: A Philosophy, Not a Product

First things first, let’s dispel the common misconception. No Red Ink isn’t a specific software or program. It’s a philosophy, a mindset shift towards mindful spending and conscious financial management. It’s the unwavering commitment to ensuring your income consistently outpaces your expenses, leaving you with a positive bank balance at the end of each month.

Think of it like this: your income is the steady flow of green paint, while your expenses are the splotches of red seeping onto your financial canvas. No Red Ink is about mastering the art of balancing these colors, ensuring the green always dominates the red, creating a masterpiece of financial stability.

The Pillars of No Red Ink:

But how do we achieve this artistic feat? It’s not about draconian restrictions or depriving yourself of all joy. No Red Ink revolves around a few key pillars:

- Budgeting: The cornerstone of No Red Ink is a well-crafted budget. Track your income and expenses, categorize your spending, and set realistic limits for each category. Think of it as building a roadmap for your money, ensuring it flows to the right destinations, not seeping into unnecessary cracks.

- Mindful Spending: Every purchase, big or small, deserves conscious consideration. Ask yourself: “Do I need this?” and “Can I afford it?” before swiping that card. Impulse buys and emotional spending are the red splatters that stain your financial artwork. Prioritize needs over wants, and watch the green dominate your canvas.

- Debt Management: Existing debt? Don’t despair! No Red Ink is about tackling debt head-on, developing a plan to pay it down systematically. Prioritize high-interest loans first, consider debt consolidation, and explore repayment options that fit your budget. Each debt conquered is a red splotch banished, one step closer to a pristine green financial landscape.

- Savings and Investments: Once you’ve stabilized your cash flow, it’s time to think about the future. Build an emergency fund for unexpected expenses, and start exploring savings and investment options to secure your long-term financial goals. These green strokes paint a picture of prosperity and security for your future self.

Tools and Resources:

The good news is, you’re not alone on this journey. Countless tools and resources can help you implement the No Red Ink philosophy. Explore budgeting apps, personal finance websites, and educational content to find what works best for you. Remember, knowledge is power, and the more you understand your finances, the more easily you can paint them in green.

Remember, No Red Ink is a journey, not a destination. There will be bumps along the road, moments of temptation, and occasional red splatters. But with consistent effort, mindful spending, and the right tools, you can achieve financial stability and paint a masterpiece of a budget. So grab your brushes, embrace the green, and remember: No Red Ink is not just a slogan, it’s a lifelong commitment to financial well-being.

Have A Look :-

- How Old Is Google?

- Nellis Auction – Overview, Networth, Guide

- Scrubs And Beyond – Overview, Networth, Guide