If you’ve ever received a bonus from your employer, you may have noticed that it doesn’t always appear on your paycheck in the same way as your regular wages. Understanding how bonuses are reflected on your check stubs maker is important for managing your finances and planning for taxes.

Understanding Bonuses

Bonuses are additional payments given to employees on top of their regular wages. They can come in various forms, including performance bonuses, signing bonuses, or profit-sharing bonuses. The determination of bonuses often depends on factors such as company policy, individual performance, or overall company performance.

Importance of Bonuses on Paycheck Stubs

Bonuses play a significant role in an employee’s overall compensation package. They can affect not only the amount of money you take home but also how much you owe in taxes.

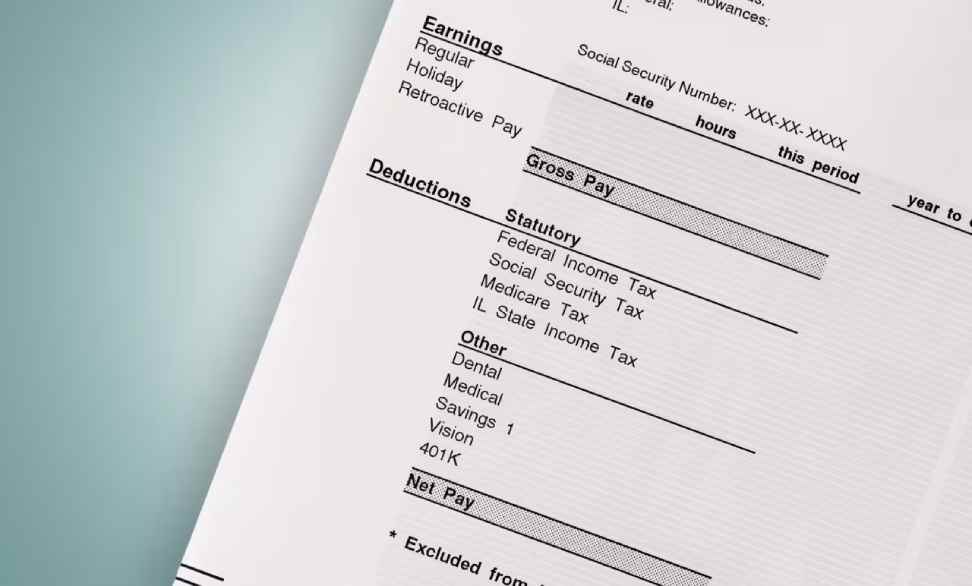

How Bonuses Are Reflected on Paycheck Stubs

When bonuses are issued, they are typically reflected on your paystub generator free as a separate line item. This means that they are listed separately from your regular wages. However, it’s essential to note that bonuses are subject to deductions and taxes, just like your regular income.

Common Questions About Bonus Payouts

How are bonuses taxed?

Bonuses are subject to federal, state, and local taxes, just like regular income. However, they may be taxed at a higher rate depending on how they are paid out and the tax withholding method chosen by your employer.

Are bonuses considered regular income?

Yes, bonuses are considered a form of income and are subject to taxation. They are typically categorized as supplemental wages and taxed accordingly.

Do all employers provide bonuses?

Not all employers provide bonuses. Whether or not you receive a bonus depends on factors such as company policy, industry standards, and individual performance.

Can bonuses be negotiated?

In some cases, bonuses can be negotiated as part of a job offer or during performance evaluations. However, this ultimately depends on the employer’s policies and discretion.

Are bonuses guaranteed?

Bonuses are often contingent on various factors, such as company performance or individual goals. While they may be promised or expected, they are not always guaranteed.

Conclusion

Understanding how bonuses are reflected on your paycheck stub is essential for managing your finances effectively. By knowing how bonuses are taxed and accounted for, you can better plan for your financial future and make informed decisions about your employment.

FAQs

How do bonuses affect taxes?

Bonuses are subject to federal, state, and local taxes, which may result in a higher tax rate compared to regular income.

Can bonuses be negotiated?

Depending on the employer’s policies and discretion, bonuses may be negotiable as part of a job offer or performance evaluation.

Are bonuses guaranteed?

While bonuses may be promised or expected, they are not always guaranteed and are often contingent on factors such as company performance or individual goals.

Do all employers provide bonuses?

Not all employers provide bonuses. Whether or not you receive a bonus depends on various factors, including company policy and industry standards.

How are bonuses reflected on paycheck stubs?

Bonuses are typically listed as a separate line item on paycheck stubs and are subject to deductions and taxes like regular income.

Have A Look :-

- Is Retail Building Materials A Good Career Path?

- Is Property-Casualty Insurers A Good Career Path?

- What Is Blooket? – Login, How To Use, And Reviews